"Returns for many hedge funds, which are supposed to be the market beaters, have paled in comparison with stocks. Hedge Fund Research’s weighted composite index is up 7.23 percent through September, according to a preliminary estimate, compared with the Standard & Poor’s 500-stock index, which, with dividends, has a total return of 12.4 percent over the same period."First of all, hedge funds come in all shapes and sizes. There are ones that invest simply in common stocks, ones that invest strictly in the bonds of distressed companies, and ones that invest strictly in energy derivatives. There are ones that use borrowed money ("leverage") to enhance returns, ones that use options, and ones that do neither. And there are ones that use combinations of these and numerous other approaches.

What there are relatively few of, though, are funds that are simply looking to be "market beaters" no matter what. Instead, what most of them offer is a a "risk-adjusted" return that beats the market, or a return profile that has other desirable characteristics. Some hedge funds specialize in creating moderate but consistent returns, for example, thereby lowering expected volatility. Others try specifically to be very uncorrelated to the overall equity markets, realizing that the vast majority of their investors have significant exposure there already which they are trying to balance. Others specifically want to avoid negative returns, and will accept less upside as a result.

What I am trying to get at with all of this is that, except in very rare circumstances, it is not the goal of a hedge fund to simply beat the market in any specific period (and certainly not over a time period as short as less than a year). They have usually promised something else to their investors, and that is what they need to be judged against.

In the aggregate, you would probably expect hedge funds to outperform the broader indices in down markets and then under perform them in significantly up markets. Why under perform? Well, the ability to do well in down markets (through options, shorting stocks, etc.) comes at a price in up markets, just like buying insurance comes at a price in those periods you don't winding up using it. That doesn't mean, though, that you shouldn't buy insurance.

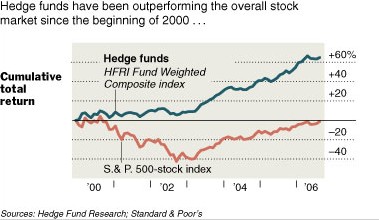

The funny part is, right in the Times own article there is evidence that things are not all amiss. Take a look at the graphic they show depicting investment performance of hedge funds versus the S&P since 2000:

If you are invested in the broad market starting in 2000, you lose money for the first three years, and only get even after another three. The hedge funds, however, preserve capital and earn modest returns during those three bad years. Since then, they look (at least by eyeballing the chart) to slightly under perform the market each year. But remember the insurance. By avoiding the pain of the down years, they wind up giving the long term investor vastly superior returns. The inability of the Times to mention (or perhaps even to notice) the significance of this graph is striking. Of course it would be great to invest in the hedge funds in the down periods and then in the market for the up periods, but unfortunately things don't work that way; we only know afterwards what the market is going to do.

If you are invested in the broad market starting in 2000, you lose money for the first three years, and only get even after another three. The hedge funds, however, preserve capital and earn modest returns during those three bad years. Since then, they look (at least by eyeballing the chart) to slightly under perform the market each year. But remember the insurance. By avoiding the pain of the down years, they wind up giving the long term investor vastly superior returns. The inability of the Times to mention (or perhaps even to notice) the significance of this graph is striking. Of course it would be great to invest in the hedge funds in the down periods and then in the market for the up periods, but unfortunately things don't work that way; we only know afterwards what the market is going to do.

The theme of the article is even more striking because of the additional information they offer. If hedge funds were overall disappointing, you would think people would stop putting as much money into them. Instead they tell us:

"And yet investors have hardly blinked. Eager for the rich, if not always predictable, returns that hedge funds promise, they continue to pour money into them and hope the next fund with a big problem will not be one of theirs. . .Huh? They tell us: 1) when things are bad, money gets pulled out, 2) 2006 has been bad, and 3) money into funds is surging in 2006 and "that flood" is not likely to end. And the point about pension funds and what they are looking for is exactly what I was talking about above, and very different from the "market beaters" they said everyone was looking for. Is there such a thing as a logic proofreader over there?

Hedge funds are Darwinian by nature: when returns are good, money flows in and when they are bad, investors scramble to get their money out as soon as possible.

So the spigot of new money into hedge funds has run hot and cold. After tapering off in 2005, with $46.9 billion flowing in, there has been a revival this year, with more than $66 billion poured into hedge funds in the first half of 2006 alone. That flood of money is not likely to end even amid the recent stumbles by hedge funds. . .

Pension funds, seeking to make up for years of being underfunded, have increasingly turned to hedge funds. Many funds that cater to such institutions boast they can deliver consistent medium-range returns — 8 to 12 percent — that permit institutions to better manage their liabilities."

There are lots of issues with hedge funds, and certainly problems with specific ones. But work this shoddy from the paper of record isn't shedding any light on them.

No comments:

Post a Comment